If you’ve been wondering what your home is worth in Edmonds, Woodway, Shoreline, or Mukilteo, you’re not alone. Home values across South Snohomish County have increased significantly over the past several years, creating substantial equity for many local homeowners — often without them realizing just how much. The big question is: how much equity do you have, and how can you use it strategically?

Home equity isn’t just a number — it’s one of your most powerful financial assets. And in today’s local real estate market, many homeowners are in a stronger position than they think.

What Is Home Equity?

Home equity is the difference between your home’s current market value and what you still owe on your mortgage.

As you:

- Pay down your loan

- And as home values rise in Edmonds, Woodway, Shoreline, and Mukilteo

Your ownership stake grows.

That growth is your equity.

According to data from the Census, a significant percentage of homeowners nationwide have built substantial equity in their homes in recent years. National housing data shows:

- 39% of homeowners own their home outright

- 27% have at least 50% equity

With strong appreciation throughout Snohomish County, many local homeowners are experiencing similar equity growth.

If you’ve owned your home for several years, there’s a good chance your equity position is stronger than you expect.

How Much Is My Home Worth in Today’s Market?

This is one of the most common searches homeowners make:

- “How much is my home worth in Edmonds?”

- “What are Woodway home values right now?”

- “Are Shoreline home prices increasing?”

- “What’s my Mukilteo property worth?”

Online estimates can provide a general range — but they often miss:

- Recent neighborhood-specific sales

- View premiums (especially in Edmonds, Shoreline and Mukilteo)

- Custom construction in Woodway

- Lot size and zoning differences

- Current buyer demand in each city

A personalized home value analysis gives you a far more accurate understanding of your equity position — and what options that opens up for you.

3 Smart Ways to Use Your Home Equity

- Move Into a Home That Better Fits Your Life

Life evolves — and your housing needs often change with it.

Maybe you’re downsizing in Edmonds.

Maybe you want more space in Shoreline.

Maybe you’re searching for a view property in Mukilteo.

Or a private estate setting in Woodway.

Your built-up equity can be used as:

- A substantial down payment

- A way to lower your next mortgage payment

- Or potentially reduce financing needs significantly

Many homeowners are using their equity to make strategic moves while maintaining financial flexibility.

- Upgrade Your Current Home

If you love your location but want improvements, reinvesting equity can be a smart long-term decision.

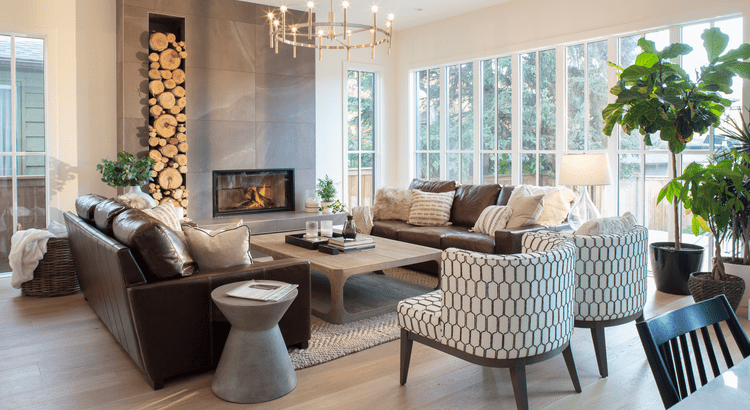

In Edmonds, Woodway, Shoreline, and Mukilteo, upgrades that often hold value include:

- Kitchen remodels

- Bathroom updates

- Outdoor living enhancements

- Energy-efficient improvements

- Deck expansions to capture views

Before committing to major renovations, it’s wise to speak with a local real estate professional. Not every improvement delivers the same return — and buyer preferences vary by city.

Knowing what adds value in your specific market matters.

- Fund a Major Life Goal

Home equity can also help fund meaningful life goals, such as:

- Starting a business

- Retirement planning

- College tuition

- Helping a child with a down payment

- Investing in additional real estate

Some homeowners explore options like cash-out refinancing or home equity lines of credit (HELOCs).

If you go this route, it’s important to maintain a healthy loan-to-value ratio (LTV). A general rule of thumb is to keep at least 20% equity in your home as a financial cushion.

With strong property values across South Snohomish County, many homeowners are in a much more secure equity position than during past housing cycles.

Next Steps: Understand Your Equity Before You Decide

If you’re curious how home values in Edmonds, Woodway, Shoreline, or Mukilteo have impacted your equity, here’s what to do:

Step 1: Request a personalized home value and equity assessment

Step 2: Review your long-term goals

Step 3: Meet with a trusted financial advisor if you’re considering tapping into equity

Understanding your position first allows you to make confident, strategic decisions — not reactive ones.

Bottom Line

Home values across Edmonds, Woodway, Shoreline, and Mukilteo have created significant equity for many homeowners.

Whether you’re considering moving, remodeling, or funding a major goal, knowing what your home is worth today is the first step.

If you’d like a personalized home value review, I’m happy to provide one — so you can see exactly where you stand. Let’s connect.

![[ai_client_name]](https://terryvehrs.com/wp-content/themes/terryvehrs-pending.com/images/accent-logo-mono.png)